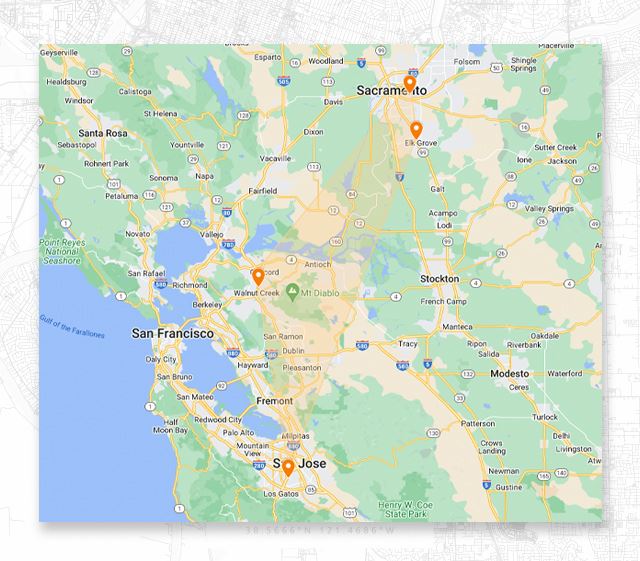

San Jose Trust & Estate Attorneys

Each of us works hard to accumulate wealth, and has intentions for how it should be passed on to our loved ones after our death. It’s also likely we have strong ideas about who should handle our care if we become incapacitated. Wills and trusts are the means of legally enforcing these desires. Our San Jose probate and estate planning attorneys can provide comprehensive guidance through the process of creating a tailored estate plan, aimed at ensuring your plans are executed as you intend.

Contact Huber Fox at (408) 207-4673 or reach out here online today to set up an initial consultation.

Wills & Trusts in San Jose

Planning one's estate starts with creating a last will and testament, where we designate beneficiaries for our assets and address the guardianship of minor children. A failure to create a will would trigger California's fixed method for asset distribution, and guardianship would be determined by the courts. The results may deviate significantly from what our wishes would have been.

Estate planning can include power of attorney arrangements, which designate an individual we trust to oversee vital medical decisions and finances, should we become incapable of managing them.

The Benefits of Establishing a Trust

Establishing a trust takes estate planning to the next level and offers several advantages. Clients can choose from different trust structures, which can be personalized based on their needs. These advantages include:

• Providing customization for asset distribution in accordance with the client's wishes. For example, a client may want to spread out the inheritance over time, withholding it all at once from their heirs. Concerns over tax issues or an adult child's financial management abilities are two instances where inheritance is regulated over time. The inheritance may also be given out at social milestones, such as completing college or getting married. Our San Jose probate and estate planning attorney can help design personalized trusts for clients.

• Transferring inheritances to a trust safeguards heirs against potential liability. Assets in a trust don't belong to an individual, but rather to the trust itself. So, when an heir goes through a divorce, assets in the trust don't count as the property that must be divided. Also, trust assets can't be accessed by creditors, thereby fending off financial risks.

• What if an heir is an adult with disabilities who qualifies for government assistance? A trust could be structured in a manner that allows the heir to receive the inheritance over time. This avoids disqualifying them from government programs that have stringent income restrictions.

The grantor themselves can benefit from a trust while still alive. Trusts provide protection from liabilities and offer prospective tax breaks. Depending on the circumstances, our San Jose probate and estate planning lawyer can recommend a sound approach for selecting and designing a trust.

Meet Our Team

Get to Know Our Trusted Team

At Huber Fox, we have the skills and experience you deserve. Get to know our team by scrolling down and select the staff you would like to learn more about.

-

Jonathan Huber Certified Specialist, Trust and Estate Litigator

Jonathan Huber Certified Specialist, Trust and Estate Litigator -

Benjamin Fox Trust and Estate Litigator

Benjamin Fox Trust and Estate Litigator -

Austin Adams Litigation Associate

Austin Adams Litigation Associate -

Hannah Myers Associate Attorney

Hannah Myers Associate Attorney -

Eric Giersch Associate Attorney

Eric Giersch Associate Attorney -

Susan Hill Retired, formerly Of Counsel

Susan Hill Retired, formerly Of Counsel -

Paula Pereira Senior Paralegal

Paula Pereira Senior Paralegal -

Shauna Krutch Paralegal

Shauna Krutch Paralegal -

Rachel Tanger Firm Administrator/Paralegal

Rachel Tanger Firm Administrator/Paralegal -

Priscilla Jauregui Administrative Assistant

Priscilla Jauregui Administrative Assistant

What Our Clients Say

Reviews & Testimonials

-

"Knowledgeable, efficient, and very professional"

Jonathan was extremely helpful in helping us establish our trust. He was knowledgeable, efficient, and very professional! I ...

- W.J. -

"Very knowledgeable, wise, and sensitive"

We hired Hannah Myers of Huber-Fox to help us with a recent restatement of our family estate trust. She showed that she is ...

- John M. -

"Very kind and very knowledgeable."

I was referred to you and I'm so glad I was. Setting up a trust can be a very emotional experience. But Hanna and her very ...

- Susan S. -

"Highly recommended."

Personable, knowledgeable and professional, highly recommended.

- Larry B. -

"Very professional, and extremely knowledgeable."

Everyone I dealt with at Hubert Fox was very professional, and extremely knowledgeable. Despite my mother ‘s efforts with ...

- Julie P. -

"Excellent experience."

Excellent experience. We are in another state across the country and the Huber Fox group represented us with the utmost ...

- Perry C. -

"Really Helpful"

The whole experience was a total blessing from God!

- Joyce A. -

"Professional"

Excellent and way professional. Hannah was very informative and took the time to explain in layman's terms all the points of ...

- Dennis M.

Trust & Probate Administration

Assigning an individual to handle the probate process or the administration of a trust is an important aspect of estate planning. Basic probate procedures involve detailed legal requirements. Trust management can also require intricate financial and legal considerations.

Moreover, the administrator shoulders fiduciary duties and is at risk of legal action if the heirs feel the deceased's wishes are not respected.

Huber Fox's comprehensive knowledge of estate planning allows us to guide clients through the administrative procedure, lessening the weight on the grieving family.

Contact Huber Fox today, either by calling (408) 207-4673 or through filling out our online contact form, and let’s set up an initial consultation.